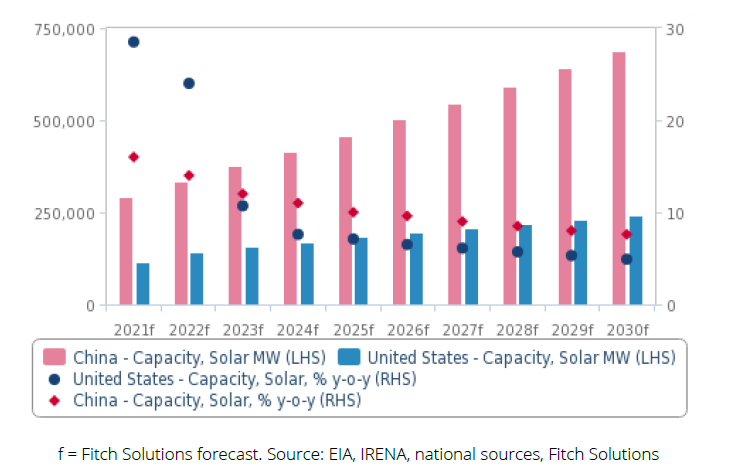

The US and China will account for a combined 57% of total forecasted solar capacity additions through 2030, with the countries adding 151.3GW and 436.9GW of solar capacity, respectively. Both countries have risks to this development, however, with the US needing to overcome trade and tariff problems, while China needs to ensure the reliability of PV production.

That’s according to Fitch Solutions’ latest Solar Power Investment Hotspots report, which also names Namibia as the “solar power market to watch this quarter” as forecast capacity is expected to increase 203% over the next ten years.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Improvement in the US but barriers remain

The US is set to remain the second largest solar market behind China, with solar’s share of the power mix increasing from 3.3% today to 9% by 2030. Solar power capacity is forecast to increase from 89.9GW at the end of 2020 to 241.2GW in 2030, with solar generation to hit 398TWh, according to the report.

This outlook was supported by a “sizeable utility-scale project pipeline and continued momentum for small-scale projects”.

Moreover, increasing interest in hybrid solar-plus-storage projects and increased support from the Biden Administration has presented “significant upside risks” to Fitch Solutions’ forecast, particularly through increased funding, efforts to strengthen and expand US grid infrastructure, and the ongoing potential for a boost from solar tax credits, said the report.

“But elevated downside risks will remain over the near term due to elevated prices throughout the global solar value chain as well as ongoing uncertainty in relation to trade policies and tariffs within the US solar sector,” it said.

This is a reference to the White House’s Withhold Release Order (WRO) on products from Hoshine Industry and its subsidiaries as well as the US’ Section 201 tariffs on solar cells and modules. PV Tech Premium has deciphered what the US’s WRO means for the solar sector.

On 24 November, The US International Trade Commission (ITC) recommended that the Section 201 safeguard tariffs on solar cells and modules be extended despite calls from the Solar Energy Industries Association (SEIA) to phase out the Section 201 tariffs on certain crystalline silicon PV cells from China. An exemption for bifacial solar panels from Section 201 tariffs has been reinstated after a decision passed down by the ITC.

US President Joe Biden will make a final decision on the Section 201 tariffs after they expire in February 2022.

China set to storm ahead if production issues addressed

Meanwhile, China is set to remain the largest solar market by “a wide margin” over the next decade, with its market set to account for 42% of all global solar capacity additions through 2030. The Fitch report forecast that China’s installed solar power capacity will increase from 253.4GW at the end of 2020 to 690.3GW in 2030. China is targeting 1.2TW of renewables by 2030 in its latest Nationally Determined Contribution submitted to the UN.

Solar power generation will reach 771TWh by 2030, according to the report, and solar’s share of the power generation mix will increase from 3.5% to 7.5% over the same period, it said. Fitch Solutions’ outlook is “supported by a sizeable utility-scale solar projects pipeline, including 5GW and 3GW solar facilities in Inner Mongolia and Qinghai, respectively.”

It also had a “increasingly positive outlook” for Chinese distributed solar, which it expects to “drive growth within the market”, as a result of “government subsidies for small-scale solar systems as well as increased consumer interest for commercial and residential-scale self-generation systems”.

China’s National Energy Association (NEA) has mandated for the installation of solar power systems on residential, commercial and government buildings. The NEA estimates that this programme could add between 130GW to 170GW of additional solar capacity by the end of 2023, said the report. In October, PV Tech reported that distributed generation is the future of solar PV in China, with 48GW expected to be deployed next year in the country.

The report noted that elevated prices, supply chain disruptions, energy crises and hikes in the cost of raw material as risks to China’s solar future, although it expects China to remain the primary product of solar PV equipment over the next decade. The market “currently accounts for the production of 64% of silicon materials, 80% of solar PV modules, and nearly 100% of solar ingots and wafers,” said the report.

Namibia represents a favourable policy environment

Finally, Fitch Solutions’ report highlighted Namibia as a market that holds “significant potential for additional investment” as the country is forecast to grow its solar capacity from 145MW to nearly 440MW, “accounting for 86% of the market’s forecasted non-hydro renewables growth.”

“Namibia’s solar power segment has generated increasing investor interest over the past couple of years, with a handful of projects under development,” said the report.

It pointed to a joint project by Globeleq Generation and Natura Energy, which signed a partnership agreement for the construction of the 81MW TeraSun Energy solar PV power plant in Windhoek as an example of such investment.

Furthermore, the report said that Namibia has “some of the highest levels of solar potential in the world”, averaging 300 days of sunshine per year, and that in 2019 “the Namibian government approved changes in regulations to liberalise the electricity market, which increases opportunities for private sector investment within the solar sector”.