Two US representatives have submitted a resolution to suspend the Internal Revenue Service (IRS) regulations regarding the implementation of the 45X Advanced Manufacturing Production Tax Credit (PTC) in the US, a key piece of legislation that has encouraged investment in clean energy manufacturing facilities in the country.

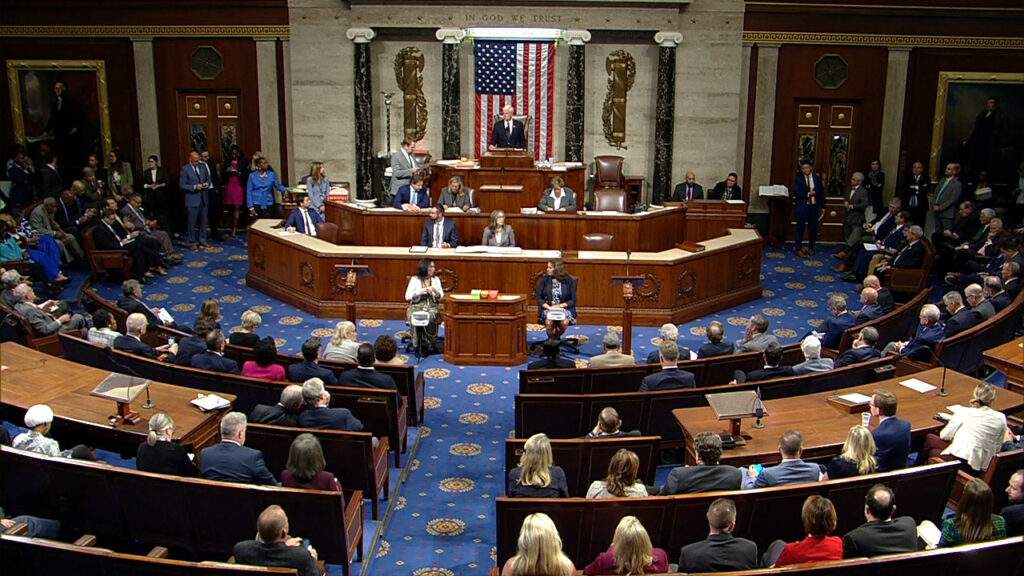

The representatives, Michigan Republican John Moolenaar and Maine Democrat Jared Golden, proposed that the tax credit implementation “shall have no force or effect” in a short document submitted to the House of Representatives. The bill will need to be passed by both the House of Representatives and the Senate, before being approved by the president, either current president Joe Biden during the current, 118th, congress, or president-elect Donald Trump if the bill is re-introducing during the next, 119th, congress.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The IRS and the Treasury finalised their rules for the implementation of the tax credit last month. Should the proposition take effect, the IRS and the Treasury would have to rewrite these rules governing the 45X tax credit. While this would not immediately overturn the 45X credit, it could disrupt a piece of legislation that had contributed to the addition of significant new solar manufacturing capacity in the US.

PV manufacturing alone has increased nearly fourfold since the passage of the Inflation Reduction Act (IRA) in 2022, but Moolenaar and Golden argue that, in its current form, the tax credits allow for foreign companies, most notably those in China, to benefit from the tax breaks provided they build facilities on US soil.

“America must be a nation of producers, not just consumers,” said Golden in the announcement of the resolution. “That’s the goal of domestic manufacturing credits: to support America’s production economy. But the Biden administration has consistently included loopholes in rulemaking that allow foreign-owned companies – including those with ties to adversarial foreign governments – to benefit from preferential tax treatment intended for American firms.

“The administration needs to go back to the drawing board and ensure they are not subsidising our global competitors.”

During a webinar held yesterday, in which the Clean Energy Associates (CEA) discussed the potential impacts of the election on the US clean energy manufacturing sector, senior policy analyst Christian Roselund suggested that foreign companies would be able to benefit from the IRA tax incentives under the legislation in its current form, but that a crackdown could be coming.

“There’s a probability, we think it’s likely, that there will be restrictions on the ability of Chinese companies to access the section 45X credit, which is the main incentive for manufacturing in the US,” said Roselund.

“Now, a fair amount of [new manufacturing facilities] are being built by Chinese companies, or [are] joint ventures that have a Chinese partner; we do think that it will be possible for most of those companies to successfully navigate the rules that will be put in place, that’s why it’s only a low to moderate market impact.”

Impacts of the new administration

Moolenaar himself has already sought to limit the benefits of the IRA tax credits on Chinese companies, submitting the ‘NO GOTION’ act in 2023 to block companies affiliated with the Chinese government from receiving production tax credits. While the bill officially stands for ‘no official giveaways of taxpayers’ income to oppressive nations’, it is notable that the bill’s acronym shares a name with Gotion, a California-based battery manufacturer that is a subsidiary of Chinese firm Gotion High Tech.

Gotion has already announced plans to invest US$2.4 billion into a new battery manufacturing plant in Michigan, the state represented by Moolenaar, and the 45X proposal builds on this recent history of seeking to exclude Chinese companies, specifically, from the IRA tax credits. With the recent re-election of Trump, who has touted a much more protectionist economic policy than Joe Biden, perhaps Moolenaar is expecting there to be greater enthusiasm for isolationist legislation.

Trump’s re-election has already impacted the work of Chinese companies active in the US solar space. On the same day that the presidential election results were published, leading Chinese module manufacturer Trina Solar sold a 5GW module facility in Texas to Freyr Battery, just one week after starting commercial operations at the factory.

While Freyr CEO Daniel Barcelo exclusively told PV Tech Premium that the company’s “long term vision is solar-plus-storage”, and that the Trina acquisition was a means to that end, Clean Energy Associates (CEA) senior policy analyst Christian Roselund acknowledged that there are already a number of “proposed policies” in place that would limit the access of foreign companies to tax credits under the IRA.

However, there is some optimism regarding the future of the US clean energy manufacturing space, considering that initiatives such as the IRA have received bipartisan support. Moolenaar and Golden’s proposal to simply eliminate the 45X credit in its entirety will likely not receive support from US-based manufacturers, and figures in both the Republican and Democrat parties, who have welcomed the greater incentives for onshoring US manufacturing capacity, according to analysis from Wood Mackenzie.

“You may recall that a few months ago, 18 Republican members of Congress wrote a letter to House speaker Mike Johnson expressing their opposition to the revoking of the ITC and the PTC,” said Roselund in yesterday’s webinar. “What these Republicans said in their letter was interesting; they said, ‘well, we didn’t vote for this, and we think this is flawed, but we have a lot of projects in our districts that are being built, and if you yank the ITC and the PTC, that’s going to do damage to our districts and to business, so don’t do it’.

“Out of those 18, 13 have won re-election,” he added, suggesting that, despite Trump’s protectionist rhetoric, there may yet be sustained support for the IRA and its tax credits in the US government moving forward.

This article has been updated to reflect that the proposition calls for a suspension of the IRS decision, rather than a suspension of the 45X credit itself.