The US Department of the Treasury (DOT) has finalised its rules for the 45X Advanced Manufacturing Production Tax Credit, as part of the US’ ongoing efforts to encourage greater domestic production of components and technologies integral to the clean energy transition.

The 45X tax credit aims to incentivise clean energy manufacturing by offering tax credits for companies who base manufacturing facilities in the US, and is a key component of the landmark Inflation Reduction Act (IRA) legislation passed in 2022. Since the passage of the IRA, the US solar sector has received around US$19 billion in private investment, alongside a further US$77 billion in the batteries industry and US$8 billion in the wind sector, and lawmakers are keen for this level of investment to continue.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

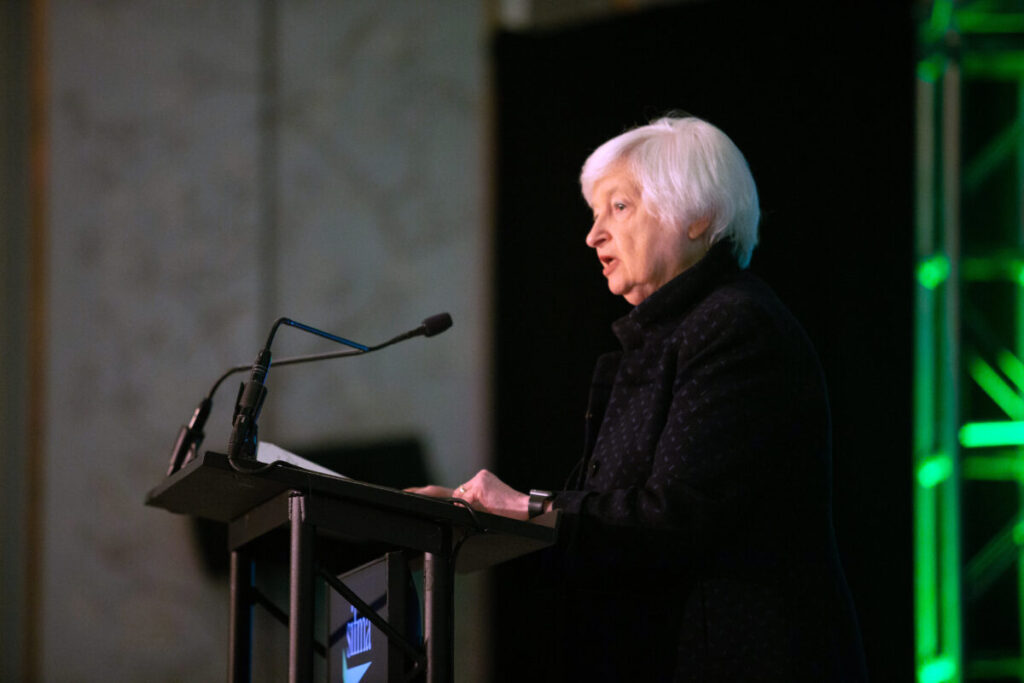

“These investments are creating good-paying jobs, strengthening US supply chains and lowering costs for American consumers and businesses,” said US secretary of the Treasury Janet L. Yellen. “The final rules announced today will help companies continue to invest and innovate in the US as we buildout our clean energy economy.”

The DOT noted that many of the credit’s rules are in line with the proposed regulations first released in December 2023, which sought to offer tax breaks until 2029, before beginning to phase out such credits from 2030 onwards for a number of technologies, including PV cells and modules.

Securing the supply chain

However, the DOT added that one change to the December 2023 proposal, following consultation with industry, is that now taxpayers will be able to include materials and extraction costs in production costs, “providing certain conditions are met”, potentially opening up more of the companies’ expenditure to potential tax credits.

This change will, in particular, seek to deliver a holistic supply chain for clean energy technologies, from the initial extraction of materials to the assembly of components and devices, such as cells and wafers.

“These final rules will help strengthen energy dominance while reducing emissions and levelling the playing field for US companies to onshore production of critical clean energy technologies—mitigating our competitors’ market manipulation,” said US secretary of energy Jennifer Granholm.

Granholm’s comments about “our competitors” likely refer to China, which has historically dominated the PV manufacturing industry, producing solar products at a significantly lower cost than the US and Europe. According to figures from Wood Mackenzie, as of July this year, the average price of a module in the US was around US$0.27/w, compared to just US$0.11/w in China.

Earlier this year, a bipartisan group of senators introduced the “American Tax Dollars for American Solar Manufacturing Act”, which sought to exclude Chinese manufacturers from accessing IRA manufacturing tax credits. The bill followed on the heels of leading Chinese manufacturer Trina Solar announcing plans to build a module manufacturing facility in Texas, and being able to produce solar products at a cost closer to that of the Chinese industry leaders will be essential to the sustenance of the US solar manufacturing sector.

Support from SEIA and ACORE

Today’s announcement was greeted warmly by the industry, with the Solar Energy Industries Association (SEIA), a trade body, commending the finalisation of “one of the most influential policies” in the US manufacturing space.

“As a result of these rules, investments in American workers and factories are here to stay,” said SEIA president and CEO Abigail Ross Hopper. “Whether it’s solar panel manufacturing in Georgia, steel rolling in Pennsylvania, or mineral production in Montana, the solar and storage industry is committed to making homegrown solar products.

“We commend Treasury and the Biden administration for their continued efforts to support domestic manufacturing and invest in our energy independence.”

This was echoed by the American Council on Renewable Energy (ACORE), which noted that in the last two years, over US$75 billion has been invested in clean energy manufacturing in the US, across technologies.

“ACORE deeply appreciates the work the Treasury Department and the Internal Revenue Service (IRS) did to finalize the Section 45X credit,” said Ray Long, president and CEO of ACORE. “The final rule issued today retains the applicability of direct pay and transferability, and provides needed flexibility for a broad range of US businesses to fully leverage the benefits and create American jobs.

“While we continue to analyse the market impacts of the final rule, we look forward to our continued partnership with the agencies on regulations that further accelerate America’s clean energy transition.”

For a summary of the rules’ significance for battery manufacturing in particular, see coverage from our sister site Energy-Storage.news here.