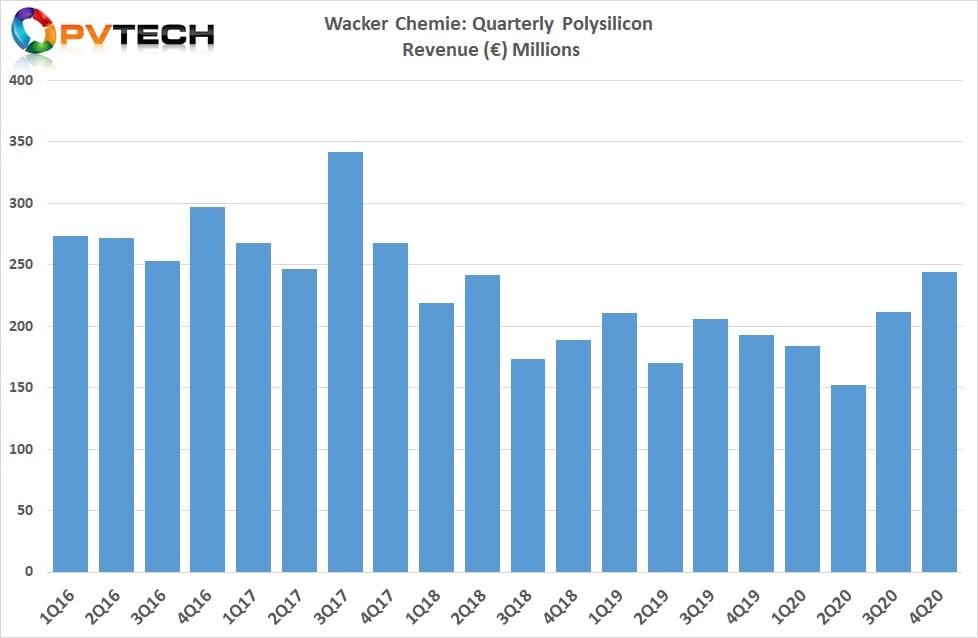

Polysilicon provider Wacker witnessed a sales recovery in the second half of 2020, but ongoing cost reductions coupled with weak first half demand led to polysilicon plant utilisation rates averaging 85%.

Wacker’s polysilicon sales hit a significant low point of €152.5 million in the second quarter of 2020, the company’s lowest quarterly figures in over 10 years.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

But Wacker responded strongly in the second half. of the year. Polysilicon sales in the fourth quarter reached €244 million, its highest quarterly levels since the fourth quarter of 2017, as the year with broadly flat year-on-year results.

Full-year 2020 polysilicon sales were €792.2 million, a 1.6% increase over the prior year.

The ongoing ‘Wacker Operating System’ (WOS) program to reduce operating costs each year meant the number of polysilicon employees declined to 2,180, down from 2,333 at the end of 2019.

As a result of the workforce reductions and higher automation and optimisation of polysilicon plants, Wacker said that its EBITDA improved by roughly €60 million in 2020. Total earnings came in slightly positive at €4.7 million compared to €56.9 million in 2019, the 2019 figure having been adjusted to reflect special income of €112.5 million in compensation for the Charleston plant explosion. EBITDA margin was 0.6% in 2020, compared to 7.3% in the previous year.

Wacker had group wide plans to save €250 million per year by the end of 2022 with non-personnel costs reductions around 50% of that total, with a total workforce reduction from global operations of around 1,200. The majority, around 1,000, of the job losses would be made in Germany.

Wacker had also focused on reducing polysilicon plant energy consumption at its German plants, notably from a new gas fired turbine resulting in a CO2 production footprint claimed to be four-times lower compared to Chinese competitors.

As part of the cost reductions, polysilicon capital expenditures were lowered to €24.9 million, compared to €35.3 million in the previous year. No plans were mentioned regarding expanding polysilicon production in 2021.

R&D expenditure was also reduced to €21.3 million in 2020, down from €30 million in 2019.

Guidance

Wacker said that it expected a mid-single-digit percentage increase in polysilicon sales in 2021, noting an improved product mix, and a slight increase in sales volumes.

A key point highlighted was polysilicon ASPs, which management said were not expected to decline in 2021 due to tight supply and increasing demand.

Wacker noted that growth in quantities and prices in recent weeks could lead to an increase in sales in the low double-digit percentage range. The EBITDA margin for 2021 is expected to increase significantly, without providing further insight.