Fluctuations in the price of power, and uncertainties about the potential returns for projects, should not dissuade investment in renewable power projects, according to speakers at Solar Media’s Renewable Energy Revenues Summit, held in London this morning.

“’What do you think is going to happen in the next 15 years?’ is a very complicated answer!’’ said Andrei-Ciprian Pop, procurement business partner at Nestle, who spoke from a buyer’s perspective at the ‘What’s a Fair Price for Power?’ panel.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

“We look at the market, we look at the global situation,” added Pop. “[We try to] keep the costs down as much as possible.”

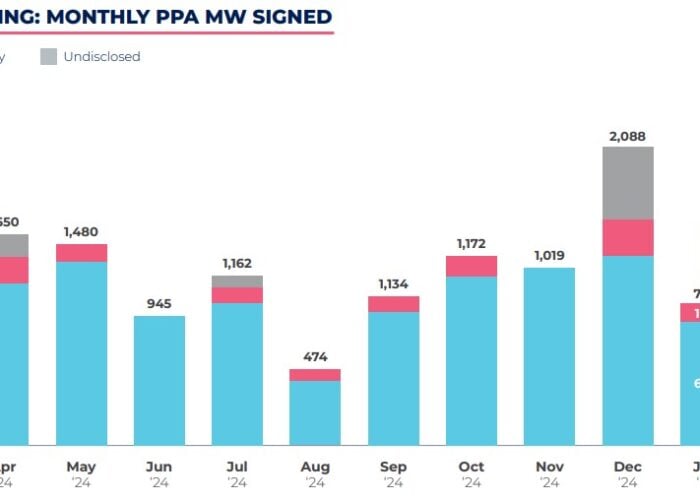

The rising price of power is well-documented – with Eurostat reporting that the average power price jumped from around €0.25/kWh (US$0.27/kWh) in 2022 to €0.29/kWh the following year – as events such as Russia’s invasion of Ukraine have disrupted the continent’s power supply. However, he suggested that such concerns have not dissuaded companies from signing power purchase agreements (PPAs).

“The way we buy has not really changed much, during the recent crises; [we look] at whether we want to take a risk over the next 12 months, or if we want to take a quarterly basis,” added Pop, suggesting that macro-economic concerns could influence some of the decision-making processes, but have not inspired a radical change in the manner in which deals are conducted.

Indeed, James Zhou, energy markets manager at Octopus Energy Generation suggested that PPAs, in particular, could see more interest, as they are an effective risk-mitigation tool in an increasingly uncertain economic environment.

“The key risk that we’re trying to manage is power price risk; trying to maximise that range of outcomes while still making decent returns. in a market where subsidies are gradually dwindling away, that’s harder to provide,” said Zhou. “PPAs are a key tool in derisking. A PPA, for us, isn’t about securing debt, but it’s a risk mitigation tool.

“When determining a fair price for power, [the question is] ‘How much is that risk reduction worth?’”

Ross Irvine, senior manager for PPA origination and structuring at EDF, said that this is of particular relevance for new companies looking to enter the corporate PPA space.

“You have to factor in the whole picture, as well as the PPA price you’re getting from a supplier,” said Irvine. David Abbott of Network Rail spoke to PV Tech Premium last year about the challenges faced by companies entering the solar space for the first time, and how PPAs can be both an integral part of these new companies’ involvement in the sector, and could provide some stability for an organisation learning the intricacies of the solar sector for the first time.

Similarly, Pop suggested that hedging could become increasingly significant, as investors look to reduce risk in increasingly diverse and complex power generation, or acquisition portfolios.

“Hedging is [one] of the strategies,” said Pop. “Hedges have a value on their own, doing nothing I would not recommend it. If we learned anything from the last year, most people have been burned by the electricity prices, especially in 2022.”

Ultimately, Zhou suggested that, while the current market environment can make decisions about the value of power and the cost of PPAs challenging to reach, this has not, and should not, dissuade interest in the sector.

“It’s a little bit slower, in general to fundraise,” said Zhou. “We are still fundraising and we’re seeing projects brought to market by developers. For us, it’s about weathering the storm and pushing through that. We want to keep executing high-quality PPAs with high-quality counterparties.”

PV Tech’s publisher, Solar Media, hosts the Renewable Energy Revenues Summit on 21-23 May 2024 in London. The event explores PPA design, the role of effective policy, evolving strategies for large energy buyers and more. For more information, go to the website.