Members of the US solar industry have voiced reactions to the US Department of Commerce (DOC) determination on countervailing duties for solar cells released this week. Amid strident political language and well-meaning plans for a US manufacturing “ecosystem,” PV Tech considers the potential winners and losers from the ongoing saga.

The DOC’s International Trade Commission (ITC) will apply tariffs to a number of solar cell manufacturers shipping to the US from Vietnam, Thailand, Malaysia and Cambodia, which it found to be receiving government subsidies in support of their operations. A total of 17 companies were named and others were alluded to in the findings, with the preliminary tariff rates varying from below 1% to almost 300%, depending on the company in question.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The affirmative preliminary determination released on Tuesday (1 October) is the first action taken by the DOC following a petition launched in April by the American Alliance for Solar Manufacturing Trade Committee seeking antidumping and countervailing duty (AD/CVD) tariffs on solar cells coming into the US from the four named countries.

The Alliance comprises US-based solar manufacturers, most notably Korean-owned Hanwha Qcells, Swiss firm Meyer Burger, polysilicon producer REC Silicon and Cadmium Telluride (CdTe) thin-film module manufacturing giant, First Solar.

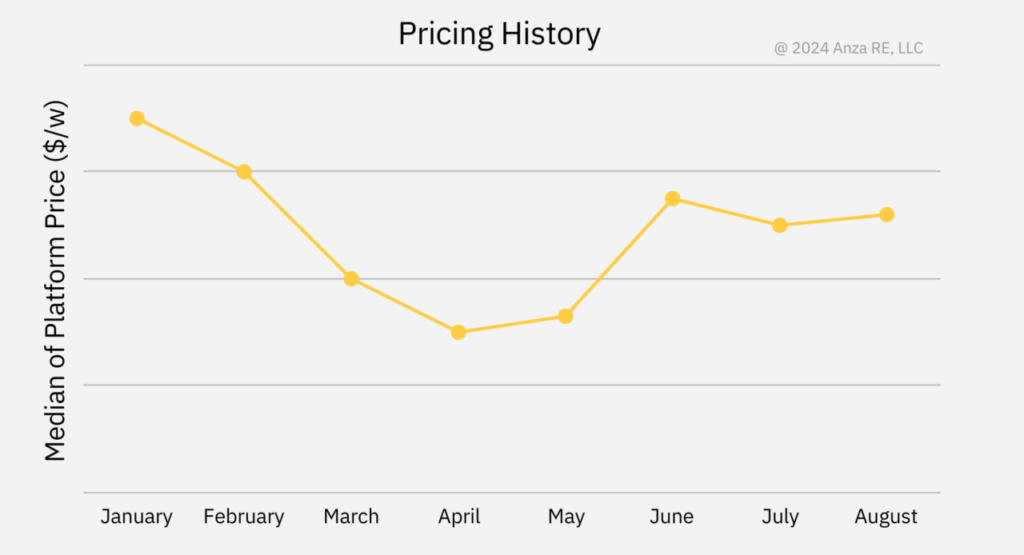

As discussed in our coverage yesterday, PV data platform Anza Renewables has published data showing an 8.8% uptick in US median module price since April, when the AD/CVD petition was launched. The extent to which module prices will rise—and the impact on US solar deployments that a price rise will have—remains up for discussion, but it’s clear that the market uncertainty brought about by the tariffs has already pushed prices up.

Following the petition in April, market analyst Clean Energy Associates (CEA) forecast that the price of US-made modules could increase by up to US$0.10/watt. This is partly due to uncertainty over the supply of cells to the US but also because the overwhelming majority of the modules being assembled in the US rely on imported cells, which, until this investigation, came mostly from Southeast Asia.

The US already has the highest solar module prices in the world and its raft of trade laws against China and Southeast Asia has partly insulated it from the collapse in module prices seen in the rest of the world. Nonetheless, in its forecast from July, CEA said that a US$0.10/watt price hike “may cause developers and manufacturers to cancel projects.”

First Solar in pole position

But higher prices are, generally speaking, good for manufacturers. The members of the American Alliance for Solar Manufacturing Trade Committee will likely stand to benefit from higher average selling prices (ASP) and less competition for cells entering the US. For example, Qcells is establishing a US$2.5 billion vertically integrated manufacturing hub in Georgia which, when complete, will produce ingots, wafers, cells and modules. The ITC named Qcells’ operations in Malaysia in its list of companies subject to tariffs.

Meyer Burger, another member of the Alliance, is also building a module facility in the US and has retained cell production capacity in Germany. Despite its recent financial difficulties, more expensive Southeast Asian imports would likely benefit the company.

None stand to benefit as much as First Solar, however. Analysis from investment banking firm Evercore said: “We believe that FSLR (First Solar) is one of the main beneficiaries of new and/or higher tariffs, which is expected to result in higher ASPs in coming quarters. Also important to note that these tariffs are not expected to impact the company’s thin-film modules imported from SEA.”

First Solar operates a module production facility in Malaysia as well as a number of US bases. Its CdTe technology is largely isolated from the geopolitical tussles that dominate the silicon supply chain and it is the largest US solar manufacturer by some distance.

First Solar’s public involvement in the AD/CVD petition came just weeks after its CEO, Mark Widmar, addressed a US Senate Finance Committee hearing using stridently protectionist language about the US manufacturing space. Widmar said the US “cannot line China’s pockets with US taxpayer dollars” and that “not even one of the crystalline silicon panels installed [in 2023] was assembled with American-made solar cells”.

He also said: “We invite competition, and we invite free trade; all we ask is that this competition and trade are practised on a level playing field.”

Higher silicon module prices, either from more expensive cell imports or US products, would suit First Solar, who are the only major thin-film player in the game.

Trina talks up Texas

Trinasolar US, the American arm of Chinese solar manufacturing giant Trinasolar, has already started construction at a 5GW module assemby plant in Texas. In a public statement following the preliminary determination, president of Trinasolar US Steven Zhu said: “The Department of Commerce preliminary determination reconfirms Trina’s commitment to the US renewable energy industry.”

“Once operational in Q4 2024, the Texas facility will produce high-power Vertex modules for utility-scale, commercial and industrial, and residential solar applications in the United States, utilising polysilicon sourced from the US and Europe, and boosting the economy with over 1,300 local jobs.”

Trina Solar Science & Technology (Thailand) Ltd was named in the ITC’s CVD determination but was listed with a tariff rate of just 0.14%. The company’s significant investment in the US perhaps means it will fare well from the tariffs, though in his statement Zhu said little about the duties themselves.

An industry divided

Speaking to this author in the most recent edition of PV Tech Power, published earlier this year, Martin Pochtaruk of Canadian solar manufacturer Heliene said that the tariff case had been disruptive and forced the company—which has manufacturing operations in Minnesota—to change its cell suppliers overnight. Many manufacturers which don’t have active cell capacity in the US will face a similar situation.

This is the story of the most recent CVD case—a short-term win for certain manufacturers and a possible setback for many others in the US value chain.

At the 2024 RE+ trade show in California last month, PV Tech identified an industry that was infighting over its priorities. In the main, developers, which have been enjoying low prices and abundant products over the last year, are largely looking to the global solar supply chain to source the cheapest and most available components to accelerate solar deployments. Simultaneously, parts of the US manufacturing industry are calling for a more isolationist attitude that prioritises domestic energy supply.

The Defend Solar USA Alliance, an organisation targeting policymakers that looks to shore up US solar manufacturing, said: “The initial determination from Commerce further proves that harm is being done to domestic solar manufacturers. When Commerce finishes its full investigation into these unfair practices, we expect the tariffs to align with the reality—companies backed by China’s government aren’t playing by the rules and are undermining America’s workforce, national security, and economy.”

However, analysts like CEA have warned of project delays, cancellations and finance issues that could adversely impact the US’ energy prices and wider energy transition. In the battle for the soul of US solar, it has become common to hear people involved in the downstream of the industry advocating for more positive incentives for domestic manufacturing, rather than hard-and-fast trade defences.

On the global scale, another emerging factor is the recent move of some major Chinese solar manufacturers into the Middle East. It is unclear which markets these projects, such as a 10GW undertaking by JinkoSolar in Saudi Arabia, will target, but in a few years, that could prove the next solar trade battleground.

The final determination by the ITC, due next year, could see some of the affected companies and duty rates change.