As solar PV technology becomes more commercially viable, there has been a surge in patents, covering not just fundamental materials but also more niche areas such as electronics and manufacturing processes. This increase in patent filings has been accompanied by a recent rise in litigation, driven largely by the maturity of tunnel oxide passivated contact (TOPCon) technology.

According to two lawyers speaking to PV Tech Premium, industry price pressures may also be encouraging companies to take a more aggressive stance in enforcing their patents. The stakes are high, as losing a patent dispute can mean losing access to a sales market for specific products, leading to sharply reduced revenues. In some countries, injunctions could even require the removal of infringing solar modules from large-scale installations.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

A large number of companies are now embroiled in these battles including the likes of Maxeon, Aiko, Hanwha Q Cells, First Solar, Trina Solar, Runergy, Adani, JA Solar and Astronergy among others.

Today, a cost-efficient and highly automated PV cell and module fabrication can be established almost anywhere, says Dr. Stefan Lange of PV quality assurance organisation Fraunhofer Center for Silicon-Photovoltaics CSP. However, developing new solar cell and module technologies is both time consuming and expensive, and the global market faces intense competition due to an oversupply. This is why innovative companies are increasingly focused on defending their intellectual property rights.

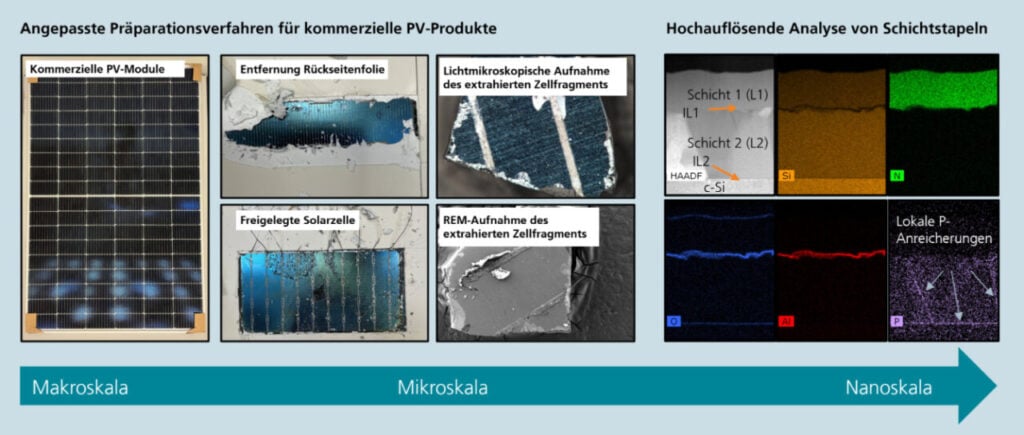

“Often, patents involve only microscopic or nanoscopic features or thin film interfaces whose properties are challenging to characterise,” says Lange. “That’s even more pronounced with new technologies like silicon heterojunction, TOPCon or back contact solar cells.”

The increasing need for higher spatial resolution and measurement sensitivity has driven Fraunhofer CSP, in collaboration with many industry partners, to develop new measurement methods to detect patent infringements (see boxout, below).

Typically, when a technology begins to take off, there is a wave of patent filings. However, as the most obvious innovations get patented, future patents tend to focus on more specialised areas. The uptick in PV patent litigation is likely a result of certain technologies, such as TOPCon, reaching a level of maturity that attracts attention.

“In the solar space, we’ve seen patents not just for the obvious things like materials, but also for niche areas around electronics, software, manufacturing processes, cell structures and array structures,” says Tim Harris, IP partner at law firm Osborne Clarke.

The power of patents

Patents must be enforced through litigation, often on a country-by-country basis, but if successful, they can result in royalties or even block a competitor from using the patented technology. In some cases, modules from large PV projects may need to be dismounted depending on the country’s legal framework.

“In Germany, for example, which takes quite a strict approach, if you infringe the patent, there’s a good chance that an injunction would be granted and you might have to rip up an entire deployed array,” says Harris. “This is why patents are really powerful assets.”

A recent case highlights the complexity and impact of patent challenges. In October, French start-up PV producer Carbon emerged as a third party in an ongoing dispute between rival Chinese manufacturers JA Solar and Astronergy.

Carbon weighed in after JA Solar instigated litigation against Astronergy over the alleged infringement of two of JA Solar’s TOPCon patents. Carbon, which is hoping to begin its own TOPCon production in France, was seeking to challenge the validity of one of JA Solar’s patents, thereby disrupting the lawsuit against Astronergy, as a victory for JA Solar in that will have implications for Carbon’s plans. Carbon’s challenge with European Patent Office has so far been unsuccessful.

Legal heat as TOPCon reaches critical mass

Many recent patent cases or investigations involve TOPCon technology, which is known for its higher efficiency and increasing market share. Companies holding TOPCon patents often feel they have heavily invested in both the development and protection of their intellectual property and want to have a say in how that market share develops.

Eagle Robinson, head of Patents, US, at law firm Norton Rose Fulbright, says that enforcing a patent requires substantial investment of time and resources.

“As a result, a technology often has to reach critical mass, where either the potential recovery from enforcement or the potential risk of non-enforcement outweighs the investment that it takes to enforce the patents,” he says. “I suspect that’s what we’re seeing with TOPCon technology.”

One of the more surprising cases involves US-based thin-film specialist First Solar, known for its cadmium telluride (CdTe) technology, filing claims over TOPCon-related patents. This move raised eyebrows because TOPCon technology uses crystalline silicon, which is different from First Solar’s primary material. However, the company acquired a patent portfolio related to TOPCon, which it is now seeking to enforce.

Price pressure

In Q2 of this year, PV manufacturers struggled as market prices dropped below production costs. Robinson notes that while price pressures do not drive patent infringements, they can motivate companies to be more aggressive in enforcing their patents.

In the US, if a patent holder successfully sues a competitor, the court may award a reasonable royalty, which the competitor must pay for every unit sold.

“It can add to the cost basis of your competitors and make it harder for them to sell products at lower prices,” adds Robinson.

According to Fraunhofer CSP’s Lange, recent patent cases have likely been triggered by strong competition and price pressure. Aside from technological advantages, companies also use intellectual property (IP) measures to gain market share. Losing a patent dispute can severely impact a company’s revenue by blocking sales of specific products.

Costs and pitfalls of enforcing patents

Robinson notes that while it’s difficult to generalise how successful most PV patent challenges are globally, in the US, more than 90% of patent lawsuits are settled before going to trial. This is due in part to the high cost of litigation and the uncertainty of recovering attorney’s fees.

Some cases do go to trial, particularly in markets with intense price competition. Robinson predicts that, given TOPCon’s growing efficiency and market share, more cases involving this technology could make it to court.

Maxeon, for instance, has sued three companies in the US over three patents. Canadian Solar and Hanwha Q Cells, two of the defendants, have filed petitions with the patent office to invalidate the claims, a powerful strategy in the US patent system.

While there are many variables, Robinson says that at this point, the responses from the two defendants suggest that they are “vigorously defending” against the lawsuits.

Enforcing patents does come with added risk, because whenever a patent is asserted, it is put on the line to be revoked and invalidated if the countering party is successful.

“That’s why companies generally would only want to go to court with their stronger patents,” says Harris.

Still, he notes that there is a trend where patents on technologies tend to be stronger earlier in their development cycle, while later patents tend to be narrower and potentially weaker. Patent litigation could also slow down the rollout of next-generation PV technologies. Companies must therefore carefully assess the patent landscape and legal risks before launching new products. However, Harris notes that companies have quite often not factored this aspect into their timeframes.

“If you don’t look into it, you might be okay, but you’re certainly running a risk,” Harris adds.

Robinson also speculates that patent litigation could well play an increasing role in the solar PV sector going forward.

Nanoscopic IP analysis in Europe

In response to a more competitive market, Fraunhofer CSP has launched a government-funded ‘IP Protection’ project in Germany to develop new methods for providing legally secure evidence of patent infringements.

The project focuses on analysing microscopic devices and material properties to assess patent features with legal safety in PV technologies, with the goal to support European companies by ensuring fair competition.

“It’s a lighthouse project and the first of its kind in PV research in Germany,” says Lange. “If local companies strive for a competitive advantage by investing in R&D, we want to support them through effective patent protection.”

However, newer technologies demand more sophisticated analysis methods that are often not sufficiently explored.

Patents often involve statistically distributed microscopic or nanoscopic features related to the transport of electrical current across the layer stack or the passivation properties (e.g. pinholes within the SiO2 tunnel oxide of TOPCon structures). With its new project, Fraunhofer aims to develop methods to find those structural features even if they are still buried beneath other layers and to assess their functional properties.